The NILS Loan Application Form is a document that allows individuals to apply for a No Interest Loan (NILS) in Queensland. The form can be completed online or in person at a NILS provider. To apply, you will need to provide personal information, income details, and supporting documentation. The application process typically takes between 2-4 days to be assessed;

What is NILS?

NILS, which stands for No Interest Loan Scheme, is a community-based program that provides individuals and families on low incomes with access to safe, fair, and affordable credit. It’s a microloan scheme that allows people to borrow small amounts of money without any interest charges or fees. NILS aims to help individuals and families purchase essential goods and services, such as household appliances, car repairs, medical expenses, and education costs, without having to resort to high-interest loans or payday lenders. NILS loans are typically offered for a maximum amount of $2,000, with repayment terms ranging from 12 to 18 months.

NILS is administered by Good Shepherd Microfinance in partnership with not-for-profit community organizations across Australia. The program is available in over 600 locations nationwide, including Queensland. To be eligible for a NILS loan, individuals must meet certain criteria, which may vary depending on the provider. These criteria typically include having a low income, being a resident of the state where the loan is being applied for, and being able to demonstrate that they can afford to repay the loan.

Eligibility Criteria

To be eligible for a NILS loan in Queensland, you must generally meet the following criteria⁚

- Residency⁚ You must be a resident of Queensland.

- Income⁚ You must be earning a net income of less than $70,000 per year as a single person or less than $100,000 per year if you have a partner or children. Some providers may have slightly different income thresholds.

- Financial Circumstances⁚ You must be able to demonstrate that you can afford to repay the loan. This may involve providing documentation such as payslips or bank statements.

- Health Care Card/Pension Card⁚ Holding a current Health Care Card or receiving a Centrelink payment is typically a requirement for eligibility, but not always.

- Other Considerations⁚ Some providers may consider other factors, such as whether you have experienced family or domestic violence in the last 10 years.

It’s important to note that these are general eligibility criteria, and specific requirements may vary depending on the NILS provider. You should contact your local NILS provider directly to confirm the specific eligibility requirements for their program.

How to Apply

Applying for a NILS loan in Queensland is generally a straightforward process. Here’s a general guide⁚

- Identify a NILS Provider⁚ Locate a NILS provider in your area. You can find a list of NILS providers in Queensland on the Good Shepherd Microfinance website or by contacting your local community organization.

- Contact the Provider⁚ Reach out to the NILS provider to inquire about their application process and eligibility requirements. You can typically apply online, by phone, or in person.

- Gather Required Documentation⁚ Prepare the necessary documents, such as proof of identity, income verification (payslips, bank statements), and residency documentation.

- Complete the Application Form⁚ Fill out the NILS Loan Application Form accurately and completely. Be sure to provide all the required information.

- Submit Your Application⁚ Submit your completed application form and supporting documentation to the NILS provider. This can be done online, by mail, or in person.

- Assessment Process⁚ The NILS provider will review your application and supporting documents. They may contact you for additional information or clarification.

- Loan Approval⁚ If your application is approved, you will be notified. You will then need to sign the loan agreement and receive your loan funds.

The application process may vary slightly depending on the NILS provider, so it’s always best to check with them for specific details.

Application Process

The application process for a NILS loan in Queensland generally involves the following steps⁚

- Initial Inquiry⁚ You begin by contacting the NILS provider, either by phone, email, or visiting their office. They will discuss your eligibility and guide you through the application process.

- Interview⁚ Some NILS providers may require an interview, either in person at a community center or over the phone. This allows them to assess your needs and financial situation.

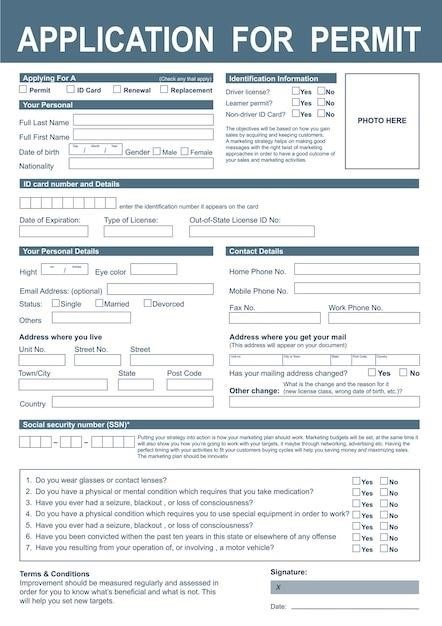

- Application Form Completion⁚ You’ll be provided with a NILS Loan Application Form to complete. This form will require you to provide personal information, income details, and loan purpose.

- Supporting Documentation⁚ Gather the necessary supporting documentation, such as proof of identity, income verification, and residency documentation;

- Application Submission⁚ Submit your completed application form and supporting documents to the NILS provider.

- Assessment⁚ The NILS provider will review your application and supporting documents. This may involve a credit check to verify your financial history.

- Decision⁚ The provider will inform you of their decision regarding your loan application. If approved, you’ll be provided with the loan agreement to sign.

- Loan Disbursement⁚ Once the loan agreement is signed, the NILS provider will disburse the loan funds to you, typically within a few business days.

The NILS application process is designed to be simple and accessible. It emphasizes affordability and support for individuals and families on low incomes.

Supporting Documentation

To complete your NILS loan application in Queensland, you will need to provide supporting documentation that verifies your identity, income, and residency. The specific documents required may vary slightly depending on the NILS provider, but generally include the following⁚

- Proof of Identity⁚ This could include your driver’s license, passport, or Medicare card.

- Proof of Income⁚ Provide documentation that shows your income, such as your recent payslips, Centrelink payment statements, or tax returns.

- Proof of Residency⁚ This can be a recent utility bill, bank statement, or rental agreement with your name and address.

- Proof of Loan Purpose⁚ You may need to provide documentation that supports your reason for needing the loan. This could be a quote for the item you wish to purchase, medical bills, or a lease agreement.

- Health Care Card or Pension Card⁚ If you hold a Health Care Card or Pension Card, provide a copy of this as it may be required to meet eligibility criteria.

It’s essential to ensure that all supporting documents are clear, legible, and current. Contact your NILS provider if you are unsure about the specific documents they require or if you have any questions about the application process.

Loan Amount and Repayment

The loan amount available through the NILS program in Queensland can vary depending on your individual circumstances and the NILS provider. Generally, you can borrow up to $2,000 for essential goods and services, such as appliances, furniture, car repairs, medical expenses, or educational costs. In some cases, you may be eligible for a larger loan of up to $3,000, particularly for purposes like bond and rent in advance or recovery from a natural disaster.

NILS loans are designed to be affordable and manageable, with repayment terms tailored to your individual needs. Repayment periods typically range from 12 to 18 months, with flexible repayment options available to suit your financial situation.

Importantly, NILS loans are interest-free, meaning you only pay back the amount you borrow; There are no fees or charges associated with the loan, making it a safe and responsible way to access credit.

If you are unsure about the loan amount or repayment options available to you, contact your local NILS provider for more information. They can provide personalized guidance and assist you with developing a repayment plan that fits your budget.

Where to Apply

Applying for a NILS loan in Queensland is a straightforward process. You can apply through a variety of avenues, depending on your location and preferences.

One common way to apply is through a local community organization that acts as a NILS provider. These organizations are often located in various areas across Queensland and are well-equipped to assist you with the application process.

You can also apply online through the websites of some NILS providers. These online platforms offer a convenient and efficient way to submit your application and supporting documentation.

If you prefer a more personalized approach, you can contact your local NILS provider directly to schedule an appointment for an in-person application.

To find a NILS provider near you, you can visit the Good Shepherd Microfinance website and use their online locator tool. This tool allows you to search for providers by location and provides contact information to get in touch with them.

NILS Providers in QLD

NILS providers in Queensland are diverse and dedicated to assisting individuals and families on low incomes access safe and affordable credit. These providers are often community-based organizations that partner with Good Shepherd Microfinance to offer the NILS program.

Some of the prominent NILS providers in Queensland include⁚

- Community Care Beenleigh

- Cairns Housing Service Centre

- Gold Coast Housing Service Centre

- Good Money community finance stores

- Communify (Bardon)

- Carers Queensland

- Salvation Army

- Freedom Centre

- Bundaberg and District Neighbourhood Centre

This list is not exhaustive, and there are numerous other NILS providers operating in Queensland. To find a provider near you, you can use the Good Shepherd Microfinance website’s online locator tool. It enables you to search for providers by location and provides contact information for easy communication.

Benefits of NILS

NILS offers a range of benefits to individuals and families on low incomes in Queensland, providing them with a lifeline to access essential goods and services without falling into a cycle of debt.

Here are some of the key benefits of NILS⁚

- Interest-free loans⁚ NILS loans are entirely interest-free, eliminating the burden of accumulating debt and making repayments more manageable. This ensures that borrowers pay back only the principal amount they borrowed.

- Affordable repayments⁚ NILS providers work with borrowers to establish affordable repayment plans, taking into account their individual circumstances and income levels. The repayment period is typically between 12 and 18 months, providing flexibility for borrowers to manage their finances effectively.

- Access to essential goods and services⁚ NILS loans can be used for a variety of purposes, including purchasing essential household items like fridges, washing machines, furniture, and even medical equipment. This helps individuals and families improve their living conditions and well-being.

- Financial stability and empowerment⁚ By providing access to affordable credit, NILS empowers individuals and families to take control of their financial situations, enabling them to make necessary purchases without resorting to high-interest loans or other risky financial practices.

- Support and guidance⁚ NILS providers offer support and guidance to borrowers throughout the loan process. They provide financial counseling, budgeting advice, and other resources to help borrowers manage their finances effectively.

The benefits of NILS extend beyond the immediate financial assistance, promoting financial stability and well-being for individuals and families in Queensland.

NILS for Specific Needs

The No Interest Loan Scheme (NILS) recognizes that different individuals and families have unique needs and circumstances. To cater to these specific needs, NILS providers offer specialized loan programs designed to address particular situations.

Here are some examples of NILS programs tailored for specific needs⁚

- Housing Loans⁚ NILS offers housing loans to help individuals and families cover essential housing costs such as bond, rent in advance, and even rates. These loans are particularly helpful for those transitioning into new homes or facing financial challenges related to housing.

- Carer Loans⁚ Recognizing the financial pressures faced by carers, NILS provides dedicated loans to support individuals caring for family members or friends. These loans can help cover unexpected costs associated with caregiving, providing much-needed financial assistance during challenging times.

- Disaster Recovery Loans⁚ In the wake of natural disasters, NILS offers disaster recovery loans to help individuals and families rebuild their lives. These loans can cover essential expenses like repairs, replacement of damaged goods, and other recovery-related costs.

- Education Loans⁚ NILS can also be used for educational purposes, supporting individuals and families with costs associated with education. This can include expenses like tuition fees, educational resources, and technology required for learning.

These specialized NILS programs demonstrate the scheme’s commitment to providing targeted financial assistance to meet specific needs, ensuring that individuals and families can access essential support when they need it most.

Contact Information

For inquiries regarding NILS loans in Queensland, you can reach out to the following organizations and resources⁚

- Good Shepherd Microfinance⁚ Good Shepherd is a national organization that administers the No Interest Loan Scheme (NILS) across Australia, including Queensland. You can visit their website to find a NILS provider in your area. Their contact details are available on their website.

- Local NILS Providers⁚ NILS loans are offered by various local community organizations and charities in Queensland. To find a provider near you, you can search online or contact your local community center or social services agency.

- Salvation Army NILS⁚ The Salvation Army is a major provider of NILS loans in Queensland. You can reach them by phone at (02) 6241 0518 or email nilssalvationarmy.org.au for information and assistance.

- Community Care Beenleigh⁚ Community Care Beenleigh is a community organization that offers NILS loans in Queensland. You can contact them at 3807 7355 or visit their website for more information.

- Communify⁚ Communify is a community organization in Queensland that provides NILS loans. You can find their application form on their website⁚ https://communify.org.au/nils/apply.

If you have any questions or need assistance, don’t hesitate to reach out to these organizations for further information and guidance.

Frequently Asked Questions

Here are some common questions about NILS loans in Queensland⁚

- What is the maximum loan amount I can receive? The maximum loan amount for NILS in Queensland is typically $2,000, but some providers may offer higher amounts, such as $3,000 for certain purposes, like rent in advance or recovery from a natural disaster.

- What can I use a NILS loan for? You can use a NILS loan to purchase essential goods and services, including household appliances, car repairs, medical expenses, education costs, and more. However, NILS loans are not available for cash advances, gambling, or investments.

- How long do I have to repay the loan? NILS loans usually have a repayment period of 12 to 18 months, but the specific terms can vary depending on the provider.

- Are there any fees or interest charges associated with NILS loans? No, NILS loans are interest-free and have no fees or charges. You only repay the amount you borrowed.

- How do I apply for a NILS loan? You can apply for a NILS loan by contacting a local provider in your area. Many providers have online application forms or allow you to apply in person at their offices.

If you have any further questions, contact your chosen NILS provider for personalized advice.